- Starting an auto loan business can be profitable with a proper understanding of market needs and competition.

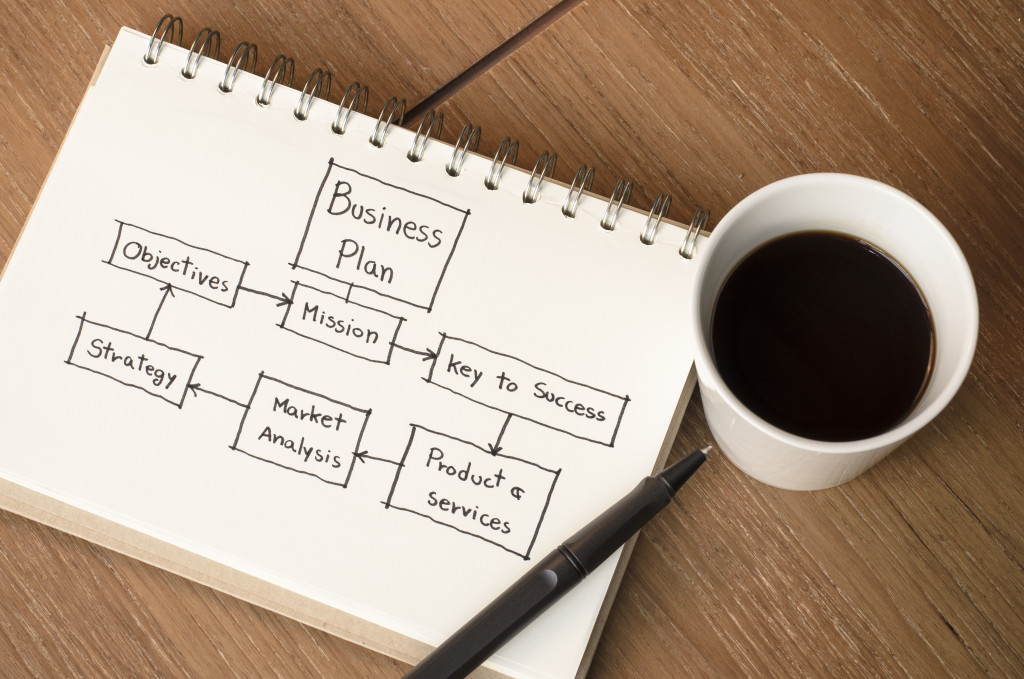

- A solid business plan is essential for setting objectives, securing funding, and managing risks.

- Technology like an auto loan soft pull system can streamline processes and improve customer service.

- Adhering to legal requirements is crucial in the highly regulated financial industry.

- Prioritizing customer service through personalization, quick response systems, staff training, and utilizing feedback can differentiate your business.

Launching an auto loan business can be lucrative, provided you navigate the industry efficiently. It’s crucial to have a solid understanding of the financial landscape, client needs, and technological tools available. Below are five essential tips for starting a thriving auto loan business.

1. Understand the Market Needs

Understanding the market’s needs is foundational. Conduct thorough market research to gauge your target demographic’s demand for auto loans. Understanding their needs, preferences, and financial behavior is crucial for crafting offers that resonate with potential clients.

Furthermore, research helps identify your competition. Learn from established auto loan businesses, study their strategies, and find out how to differentiate your services to capture a market segment.

2. Develop a Solid Business Plan

A robust business plan is your roadmap to success. It should outline your business objectives, target market, value proposition, marketing strategy, and financial projections. A well-thought-out plan guides your daily operations and helps secure funding from investors or financial institutions.

Risk management is another critical aspect to cover in your plan. Understand and prepare for the potential risks associated with the auto loan industry, such as clients defaulting on loans, economic downturns, or regulatory changes.

3. Leverage Technology

Embracing technology is non-negotiable in the modern business environment. Implementing advanced software solutions can streamline your processes, from approval applications to making your services more accessible and user-friendly for clients.

One technology you should incorporate is an auto loan soft pull. This technology allows you to pre-qualify applicants without affecting their credit scores, offering a non-intrusive way to evaluate a potential borrower’s creditworthiness. It enhances your customer service and assists in making informed lending decisions.

You could also invest in a robust customer relationship management (CRM) system. A CRM system tracks client interactions and automates tasks such as sending payment reminders, collecting data, and analyzing customer behavior.

4. Comply with Legal Requirements

In every region, starting an auto loan business entails specific legal requirements and regulations that must be adhered to. It is crucial to familiarize yourself with these guidelines to ensure compliance, as failure to do so can result in severe penalties, including the revocation of your license. Therefore, obtaining all the necessary licenses and permits is imperative before commencing operations.

To navigate the complex legal landscape of the financial industry, it is highly recommended to seek guidance from a legal expert with in-depth knowledge and experience in this field. By consulting with such professionals, you can understand the requirements and processes necessary for compliance, safeguarding your business from potential legal issues and ensuring its long-term success and stability.

5. Prioritize Customer Service

Customer service can be your biggest differentiator in a competitive auto loan industry. Providing excellent customer service builds trust and loyalty, enticing clients to return for future loans or refer others. It’s essential to invest in customer service training for your staff, as they are the face of your business.

Here are tips for prioritizing customer service:

Personalize the Customer Experience

Customers appreciate and tend to remain loyal to businesses that make them feel valued and understood. By personalizing the customer experience, you can exceed customer expectations and create a strong bond. Utilize CRM systems to understand your customers’ preferences and tailor your communications and offerings to individual needs.

Implement a Quick Response System

In the auto loan industry, time is of the essence. Clients appreciate a quick, efficient response to their queries and concerns. Implement systems to ensure prompt responses to customer inquiries through email, phone calls, or social media platforms. Timely communication enhances customer satisfaction and portrays your business as reliable.

Continually Train Your Staff

Providing exceptional customer service requires a skilled and knowledgeable team. Invest in training programs that equip your staff with the necessary skills, such as effective communication and problem-solving techniques. Set standards for handling difficult customers or unusual situations to ensure consistency in customer service.

Seek and Utilize Customer Feedback

Customer feedback is an invaluable tool for understanding how your services are perceived and where improvements can be made. Regularly solicit feedback through surveys, social media, or directly during interactions. Act on this feedback to address issues and enhance service delivery, demonstrating your commitment to customer satisfaction.

Final Words

Starting an auto loan business demands careful planning, understanding of the market, compliance with legal requirements, and leveraging technology. Following these crucial tips and incorporating an auto loan soft pull system will mitigate risks and position your business for success in the competitive auto loan industry.